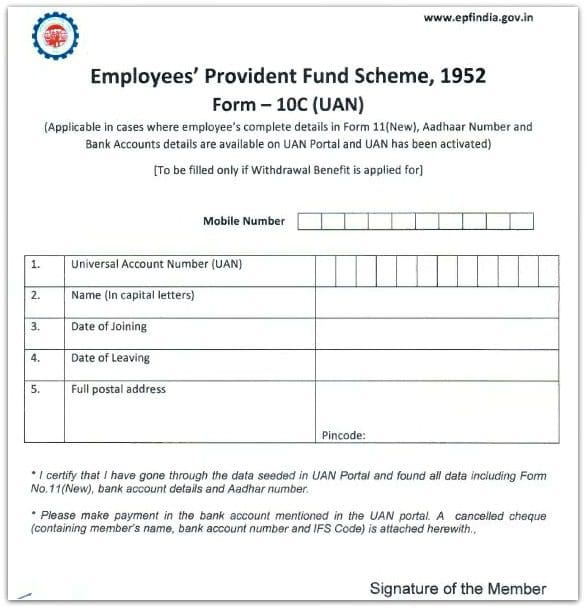

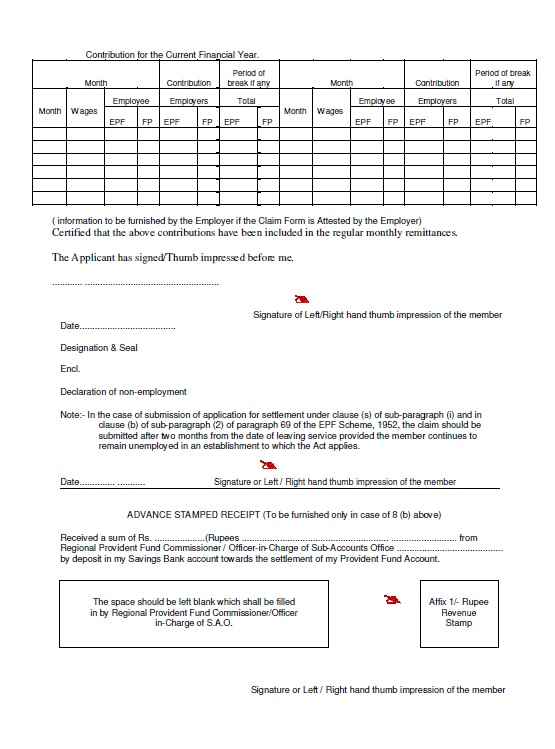

EPF Withdrawal rules According to EPF rules, a salaried person can withdraw from his/her PF account only in two cases: first, he/she has no job, and second, when two months have passed since the person was last employed i.e. An EPF subscriber can withdraw a part of his/her accumulated savings from the PF, only for some specific life events. It helps salaried employees save a part of their earnings each month, thereby building a tax-exempt corpus which is handed over at the time of retirement.ĮPFs, or simply PFs, are a long-term savings tool that helps retired employees to lead a financially stable life. Withdrawal rules 2016 for EPF and procedure for EPF Grievance redressal: The Employee Provident Fund (EPF) is managed by the Employee Provident Fund Organisation (EPFO) of India, a statutory body under the labour ministry.

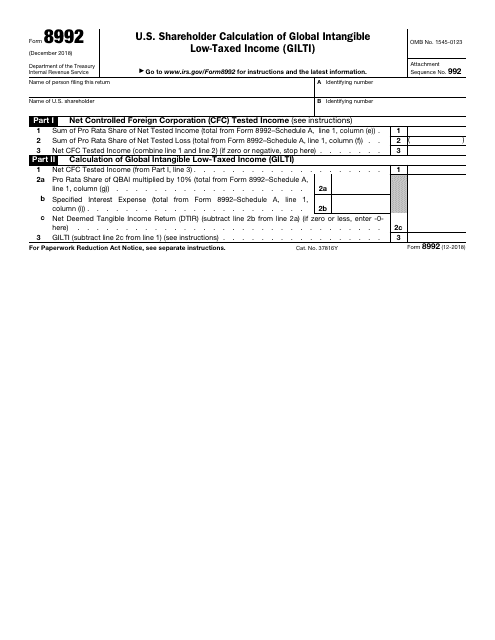

Of the Income-tax Rules, 1962 in the TDS statement. 15G received by him during a quarter of the financial year and report this reference.

In-case I am not able to submit FORM 15G along with PF Withdrawal form then can I get the TDS refund.

0 kommentar(er)

0 kommentar(er)